Loading

Get In Pursuing To Get Information On The Requirements Of Updating Franchise Tax Certification Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the In Pursuing To Get Information On The Requirements Of Updating Franchise Tax Certification Of online

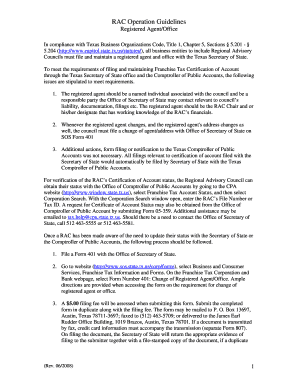

This guide provides clear instructions on filling out the form related to updating Franchise Tax Certification. Designed for users with varying levels of experience, it aims to simplify the process and ensure compliance with Texas regulations.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Provide the legal name of the entity in the Entity Information section. It is recommended to include the file number for efficient processing.

- Enter the current registered agent's name and registered office address as per the records maintained by the Secretary of State.

- In the Changes to Registered Office and/or Registered Agent section, specify the new registered agent's name. You may choose between an organization or an individual resident in the state. Complete this section with either Option A or B. If the address has changed, also fill out Section C.

- Ensure that the new registered office's address is a valid street address where service of process can be served, and cannot be a P.O. Box.

- In the Statement of Approval section, confirm that the changes have been authorized as required by the relevant law governing the filing entity.

- Select the effectiveness of filing option: A (effective upon filing), B (effective at a later date), or C (effective upon a future event). Provide necessary details for the selected option, if applicable.

- Sign and date the document in the Execution section. An authorized person from the entity must sign, and there is no requirement for notarization.

- After reviewing all information for accuracy, submit the completed form in duplicate along with the required filing fee of $5. The submission can be done via mail, fax, or in person.

- Once submitted, retain a copy of the filing evidence returned by the Secretary of State for your records.

Complete your Franchise Tax Certification updates online today.

No Tax Due Threshold For reports originally due on or after Jan. 1, 2024, the no tax due threshold is increased to $2,470,000 and entities whose annualized total revenue from their entire business is less than or equal to that amount are no longer required to file a No Tax Due Report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.