Loading

Get Canada Ccaa Donation Request Form 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CCAA Donation Request Form online

Completing the Canada CCAA Donation Request Form online is a straightforward process that requires careful attention to detail. This guide will provide comprehensive and user-friendly instructions to assist you in filling out the form accurately and effectively.

Follow the steps to successfully complete the form.

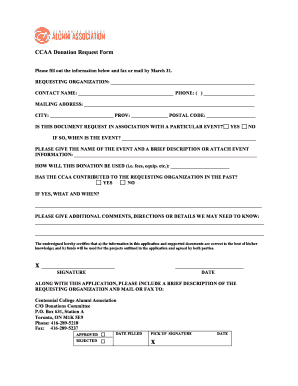

- Click 'Get Form' button to acquire the form and open it for filling out.

- Begin by entering the requesting organization’s name in the designated field. Ensure this is the official name as recognized.

- Fill in your contact name. This should be a person who can provide further information regarding the request.

- Include a phone number where you can be reached for any clarifications. This number should be active and regularly monitored.

- Input the mailing address, ensuring it is complete and accurate to avoid delays in communication.

- Specify your city, province, and postal code in their respective fields to ensure proper identification of your location.

- Indicate whether this request is associated with a specific event by checking 'Yes' or 'No'. If 'Yes', provide the date of the event.

- If applicable, give the name and a brief description of the event, or attach any additional event-related information needed.

- Clearly state how the donation will be utilized, including specifics such as fees or equipment required for the event or purpose.

- Answer whether the CCAA has contributed to your organization in the past by marking 'Yes' or 'No'. If 'Yes', include details of the contributions.

- Provide any additional comments, directions, or details that may be important for the reviewing committee to know.

- Read over your application to ensure all information is accurate. Once completed, save your changes.

- You can then download, print, or share the form as necessary. Lastly, fax or mail the application along with required documents to the address provided.

Ensure to complete your donation request form online today for submission.

Donor's name. Date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.