Loading

Get Application For Sales Tax Exemption By Motion Picture Or Television ... - Ok

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Sales Tax Exemption By Motion Picture Or Television Production Companies online

Filling out the Application For Sales Tax Exemption by Motion Picture or Television Production Companies is an essential step for eligible entities looking to obtain tax exemptions in Oklahoma. This guide provides a clear, step-by-step approach to successfully complete the application form online.

Follow the steps to complete your application accurately and efficiently.

- Press the ‘Get Form’ button to access the application form and open it in your document editor.

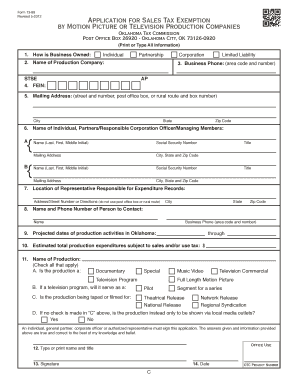

- Indicate how the business is owned by selecting one of the provided options: Individual, Partnership, Corporation, or Limited Liability.

- Enter the name of the production company in the designated field.

- Provide your Federal Employer Identification Number (FEIN). This is essential for tax identification.

- Include your business phone number, ensuring you provide the correct area code and number format.

- Fill in the mailing address, including the street number, post office box (if applicable), and zip code.

- List the names of individuals, partners, or corporation officers responsible for the application, along with their respective Social Security Numbers, titles, and mailing addresses.

- Specify the location of the representative responsible for maintaining expenditure records with an exact street address (no post office boxes).

- Provide the name and phone number of the person to contact concerning the application.

- Indicate the projected dates of production activities in Oklahoma by entering the start and end dates.

- Estimate the total production expenditures that are subject to sales and/or use tax, entering the proper dollar amount.

- Select all applicable production types (e.g., Documentary, Television Program, Music Video, etc.) and fill out relevant details as prompted.

- An authorized person must sign the application. Input their name, title, and date of signing.

- Save your changes, and ensure you download, print, or share your completed application as needed.

Start your application process online today to ensure timely tax exemption for your production.

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.