Loading

Get Trust Accounts:

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Accounts: online

This guide provides clear and comprehensive steps for filling out the Trust Accounts form online. It is designed to assist users, regardless of their legal experience, in completing the form accurately and efficiently.

Follow the steps to successfully complete your Trust Accounts form.

- Click ‘Get Form’ button to access the Trust Accounts form and open it in your preferred editor.

- Begin by entering the name and contact information for the person or law firm managing the trust account. Ensure that all details are accurate to avoid any potential issues.

- Provide the relevant details regarding the funds being held, including the total amount, the source of the funds, and the expected duration of their deposit. This information is crucial for compliance and effective trust account management.

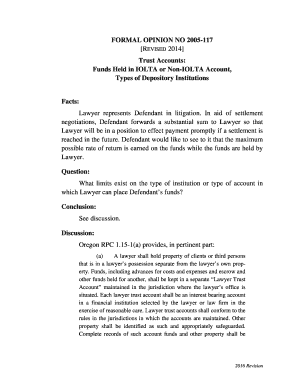

- Indicate whether the account will be an IOLTA account or a separate interest-bearing trust account. Clearly understand the distinction, as this will impact how interest is accrued and handled.

- Review the rules and requirements for maintaining the account as set forth by the Oregon RPC regulations to ensure compliance. This is essential to avoid any legal discrepancies.

- Once all required fields are filled, carefully review the form for completeness and accuracy. Make necessary corrections before finalizing.

- After completing the form, save your changes, and choose your preferred method for submission, such as downloading, printing, or sharing electronically.

Complete your Trust Accounts form online today for efficient and compliant document management.

Accounts in Trust allow the wishes of the donor to be carried out during their lifetime and/or upon death. They can specify how they want their assets managed, how and when they will be dispersed, and who will manage them. Account in Trust: Definition, Types, Benefits, How To Set One Up investopedia.com https://.investopedia.com › terms › account-in-trust investopedia.com https://.investopedia.com › terms › account-in-trust

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.