Loading

Get Credit Card Application - State Of Oklahoma

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Card Application - State Of Oklahoma online

This guide will provide you with step-by-step instructions for completing the credit card application for the State of Oklahoma online. Following these directions will help ensure that your application is filled out correctly and submitted efficiently.

Follow the steps to complete the Credit Card Application online.

- Press the ‘Get Form’ button to access the application form and open it for editing.

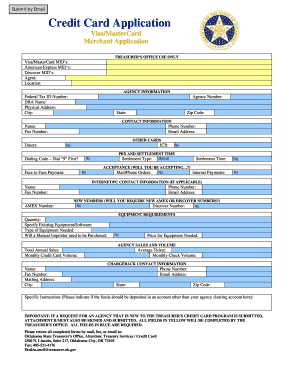

- Complete the agency information section by entering the federal tax ID number, DBA name, physical address, city, agency number, state, and zip code.

- Fill out the contact information for the individual responsible for the credit card program, including name, phone number, fax number, and email address.

- Indicate whether you will be accepting other cards such as Diners or JCB by selecting the appropriate response from the drop-down boxes.

- In the section regarding payment processing, choose the settlement type, time, and whether face-to-face or internet payments will be accepted.

- If applicable, enter the internet or PC contact information and any required American Express or Discover numbers.

- Specify the quantity and type of equipment needed, if any, and indicate if a manual imprinter will need to be purchased.

- Estimate your agency’s total annual sales, monthly credit card volume, average ticket size, and monthly check volume in the appropriate fields.

- Provide the chargeback contact information, including name, phone number, and email address.

- If there are specific instructions regarding fund deposits or additional requests, mention them in the respective field.

- Review your entries for accuracy. Once completed, save the changes, and you may download, print, or share the completed form.

Start filling out your credit card application online today!

What do credit card providers look for in an application? Your credit score is an important guide for lenders in deciding whether you're eligible for a credit card, although it's not the only factor. Card issuers will also look for: Proof of your home address and how long you've been there.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.