Loading

Get Baker College Federal Irs Form 1098-t 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

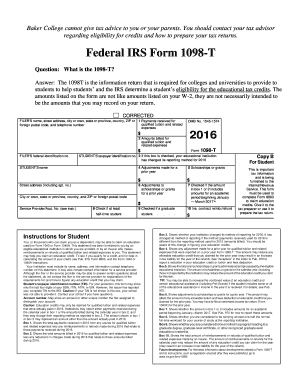

How to fill out the Baker College Federal IRS Form 1098-T online

This guide provides a step-by-step approach to filling out the Baker College Federal IRS Form 1098-T online. It is designed to be user-friendly and accessible for all individuals, regardless of their familiarity with tax documents.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to access the Baker College Federal IRS Form 1098-T and open it in an editable format.

- Review the basic information section which includes the filer's name and address. Ensure that all details are accurate and complete.

- In box 1, enter the total payments received for qualified tuition and related expenses from all sources during the reporting year. Include any adjustments that may apply.

- In box 2, list the total amounts billed for qualified tuition and related expenses during the year. Remember this may differ from the amounts paid.

- If applicable, check box 3 to indicate if there has been any change in the reporting method from the previous year.

- Complete box 4 if there are adjustments made for prior year amounts relating to qualified tuition and related expenses.

- In box 5, report the total of all scholarships or grants processed during the year that reduced your education costs.

- If there were any adjustments to scholarships or grants for a prior year, note this in box 6.

- Check box 7 if the amount in box 1 or 2 includes charges for an academic period beginning between January and March of the following year.

- Indicate in box 8 if you are considered a half-time student based on enrollment criteria.

- Check box 9 if you were enrolled in a graduate program leading to a graduate degree or certificate.

- Finally, review and double-check all entries for accuracy before saving your changes. You can then download, print, or share the completed form.

Complete your Baker College Federal IRS Form 1098-T online today to ensure accuracy and ease in filing.

You can usually access your Baker College Federal IRS Form 1098-T online through your college's student portal. Log in with your student credentials and navigate to the financial section for tax documents. If you encounter difficulties, contacting your college’s support team can help you locate and download the form easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.