Loading

Get Form A - State Of Indiana - In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM A - State Of Indiana - In online

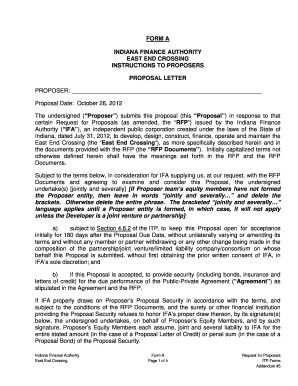

Filling out FORM A for the State of Indiana is an important step for proposers involved in the East End Crossing project. This guide provides a clear, step-by-step approach to help users complete this form accurately and efficiently online.

Follow the steps to complete FORM A successfully.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Provide your name in the 'Proposer' field, ensuring that all details match your official documents.

- Fill in the 'Proposal Date' with the date on which you are submitting the proposal.

- Review the introduction section that outlines the purpose of the proposal and the details of the Request for Proposals (RFP).

- Complete any sections regarding compliance with state laws or required certifications as specified in the form.

- Ensure you have completed the sections on the inclusion of relevant addenda and your detailed information.

- After filling in all required fields, review your entries for accuracy, then proceed to save changes, download, print, or share the form as needed.

Ensure you fill out your documents online today for a smooth submission process.

Tax penalties Failure to file information return: $10.00 penalty for each failure to file a timely return, not to exceed $25,000 in any one calendar year, is imposed; penalty is also imposed if the information return is required to be filed electronically, but is not.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.