Loading

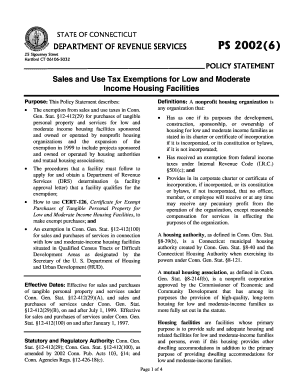

Get Sales And Use Tax Exemptions For Low And Moderate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales And Use Tax Exemptions For Low And Moderate online

Filling out the Sales And Use Tax Exemptions For Low And Moderate form can be straightforward with the right guidance. This document provides essential information and instructions for users seeking tax exemptions related to low and moderate income housing facilities.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the full description of the housing project. Include details such as location and important dates of construction and operation.

- Attach the certificate of incorporation for the sponsoring organization, or the constitution and bylaws if it is not incorporated, demonstrating its status as a nonprofit housing organization.

- Provide a copy of the organization’s current, valid determination letter from the U.S. Treasury Department, confirming its exemption from federal income taxes.

- If applicable, include a letter from the housing authority on official letterhead, signed by an authorized official, indicating their sponsorship of the project.

- Include organizing documents (certificate of incorporation or bylaws) from the owner and operator of the facility, if they differ from the sponsoring organization.

- Document the sponsorship of the construction project, ensuring clear proof is included.

- Provide documentation confirming that the facility is being or will be operated by the identified operator, including contracts if available.

- Once all necessary fields are completed and required documents are attached, review for accuracy and completeness before submission.

- Submit the form for review. Upon approval from the Department of Revenue Services, a facility approval letter will be issued.

- Use the facility approval letter when making exempt purchases for the facility, attaching it to any necessary exemption certificates.

- Finally, you can save changes, download, print, or share the completed form as necessary.

Start filling out your form online today to take advantage of applicable tax exemptions.

The Ontario sales tax credit (OSTC) is a tax-free payment designed to provide relief to low- to moderate-income Ontario residents for the sales tax they pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.