Loading

Get Estimated Tax Declaration Vouchers And Instructions For Tax Year 2009 - State Ar

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

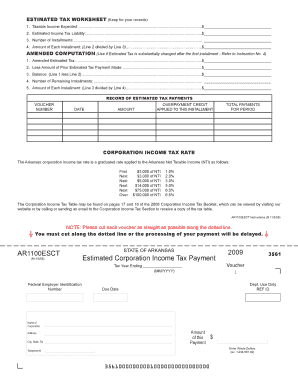

How to fill out the Estimated Tax Declaration Vouchers and Instructions for Tax Year 2009 - State Ar online

This guide provides a comprehensive overview of filling out the Estimated Tax Declaration Vouchers and Instructions for Tax Year 2009 for the State of Arkansas online. Follow these instructions to ensure a smooth and accurate completion of your tax declaration.

Follow the steps to complete your Estimated Tax Declaration vouchers seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Review the sections of the form, which include taxpayer information, estimated taxable income, and payment details. Fill in your corporation's legal name and address in the designated fields.

- Enter your Federal Employer Identification Number (EIN) accurately. This number is essential for processing your tax filings.

- Provide an estimate of your taxable income expected for the tax year, ensuring it represents the most accurate assessment of your earnings.

- Calculate your estimated income tax liability based on the Arkansas income tax rates provided in the instructions. Include any deductions or exemptions applicable.

- Decide on the number of installments you will make. The options for installment payments should reflect Arkansas’s required payment schedule outlined in the instructions.

- Confirm the amount of each installment by dividing your estimated tax liability by the number of installments you selected.

- If applicable, print and attach the completed vouchers, ensuring that each is cut along the dotted lines as indicated.

- Once all information is accurately filled out and reviewed, save your changes. You can choose to download, print, or share the completed form as needed.

Take action now by filling out the Estimated Tax Declaration Vouchers online to ensure your compliance and avoid late fees.

What Is Form 1040-V? It's a statement you send with your check or money order for any balance due on the “Amount you owe” line of your 2024 Form 1040, 1040-SR, or 1040-NR. You can make electronic payments online, by phone, or from a mobile device. Paying electronically is safe and secure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.