Loading

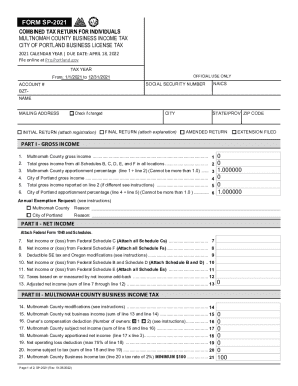

Get Or Combined Tax Return For Individuals - Multnomah County 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Combined Tax Return For Individuals - Multnomah County online

Filing taxes can be a complex task, but with the right guidance, it becomes manageable. This guide provides a detailed overview of filling out the OR Combined Tax Return for Individuals specific to Multnomah County online.

Follow the steps to complete your tax return efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year at the top of the form. For the current return, this will typically be from '1/1/2021 to 12/31/2021'.

- Provide your Social Security Number and your account number in the designated fields.

- Fill in the NAICS code that corresponds to your business activities. This information can usually be found on your Federal Schedule C.

- Complete the mailing address section accurately, including city, state, and zip code. Make sure to check the box if this address has changed since your last return.

- Select the appropriate return type: Initial, Final, Amended, or Extension filed. Attach any necessary documents based on your selection.

- In Part I, report your gross income for both Multnomah County and the City of Portland. Fill in the necessary lines based on your total earnings across all locations.

- Continue to Part II to determine your net income by including figures from your Federal Schedules (C, F, B, D, E). Attach all relevant schedules.

- In Part III, calculate your Multnomah County Business Income Tax based on your net income, applying any modifications as needed.

- Proceed to Part IV to determine the City of Portland Business License Tax, applying any pertinent modifications similar to the previous section.

- In Part V, finalize your calculations by determining the total taxes due or any potential refund. Fill out the appropriate lines to indicate how you want to handle any overpayment.

- Review the entire form for completeness and accuracy before saving your changes. Once satisfied, download, print, or share the form as necessary.

Take the next step in managing your tax responsibilities by filling out the OR Combined Tax Return online today.

If your gross income is greater than the amount corresponding to your filing status and boxes checked, you are required to file an Oregon state tax return. Note: If you are being claimed as a dependent on another taxpayer's return, your filing threshold is $1,250.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.