Loading

Get Tiaa F11185 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TIAA F11185 online

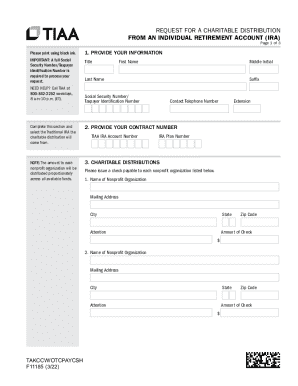

Filling out the TIAA F11185 form for charitable distributions from an Individual Retirement Account (IRA) is a crucial step in your charitable giving process. This guide provides clear, step-by-step instructions to help you complete the form successfully.

Follow the steps to complete the TIAA F11185 form online.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- In the first section, provide your information. You must enter your title, first name, middle initial, last name, suffix, Social Security Number or Taxpayer Identification Number, and contact telephone number. Ensure that all information is accurate, as a complete Social Security Number or Taxpayer Identification Number is required to process your request.

- Next, identify your IRA contract number. This number is crucial for processing your charitable distribution request.

- In the 'Charitable Distributions' section, enter your TIAA IRA account number and IRA plan number. You will also need to specify the nonprofit organizations that will receive the distributions. For each organization, provide its name, mailing address, city, state, and zip code along with the amount of the check you wish to issue. If listing additional organizations, make copies of this page as needed.

- In the final section, sign your form. Acknowledge your understanding of the responsibilities concerning the distribution, including any tax implications. Use black ink for your signature, and ensure you include today’s date.

- Once all sections are completed, you can save changes, download, print, or share the form as necessary. Ensure you return all numbered pages, even if some were not completed.

Start your online charitable distribution process by filling out the TIAA F11185 form today.

Related links form

Yes. Although you cannot make QCDs to your donor-advised fund account during your lifetime, you can donate traditional IRA, 401(k), and some other tax-deferred assets to a donor-advised fund account upon death by way of a beneficiary designation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.