Loading

Get Mn Cr-h 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN CR-H online

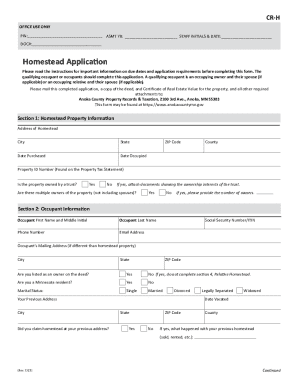

Completing the MN CR-H homestead application is an essential step for qualifying occupants seeking property tax benefits. This guide provides a clear, step-by-step approach to filling out this form online, ensuring a smooth submission process.

Follow the steps to successfully complete the MN CR-H online.

- Press the ‘Get Form’ button to access the MN CR-H form and open it within your document editor.

- Enter the homestead property information in Section 1, including the address, purchase date, occupancy date, zip code, county, and property ID number. Indicate if the property is owned by a trust and, if applicable, provide ownership documents.

- In Section 2, complete the occupant information. Enter the first and last name of the occupant, along with their phone number, email address, and Social Security number or ITIN. If the mailing address differs from the homestead property, include that as well. Indicate if they are an owner on the deed and if they are a resident of Minnesota.

- Fill out Section 3 for spouse information, including first and last name, phone number, email address, and Social Security number or ITIN. Specify if the spouse occupies the property and provide their previous address if applicable.

- Complete Section 4 only if applying as a qualifying relative. Provide the property owner's details and the relationship to the property owner.

- Sign Section 5 to certify that the information provided is accurate. Ensure all required parties, including spouses or other occupants, sign and date this section.

- After completing the application, save your changes, download a copy for your records, and prepare to print it out.

- Finally, mail the completed application, along with any required attachments, to Anoka County Property Records & Taxation at the specified address.

Begin filling out your MN CR-H application online today to secure your homestead benefits.

Related links form

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.