Loading

Get Ssa-7050-f4 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-7050-F4 online

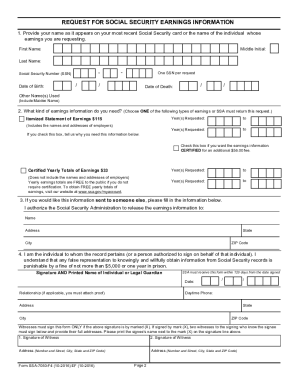

Filling out the SSA-7050-F4 form, a request for social security earnings information, can be straightforward with the right guidance. This comprehensive guide will help you navigate each section of the form with clarity and ease.

Follow the steps to successfully complete your request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name as it appears on your most recent Social Security card, including your first name, middle initial, last name, and social security number (SSN), ensuring one SSN per request.

- Indicate your date of birth and, if applicable, the date of death for the individual whose earnings information you are requesting.

- Select the kind of earnings information you need by checking one of the options: Itemized Statement of Earnings or Certified Yearly Totals of Earnings.

- If requesting an Itemized Statement, provide the necessary years of earnings requested, including the option for certification if desired.

- If you wish to send this information to someone else, fill in their name and address in the designated section.

- Affirm your authorization by signing the form as the individual to whom the record pertains or as someone authorized to sign on behalf of that individual.

- Provide your daytime phone number and mailing address to ensure the information is sent correctly.

- Complete the payment section if you are including a credit card, check, or money order for the requested information.

- Submit the completed form, with any required supporting documentation, to the Social Security Administration, allowing adequate time for processing.

Start filling out your SSA-7050-F4 form online today to ensure you receive your essential earnings information.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can get your personal Social Security Statement online by using your my Social Security account. If you don't yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.