Loading

Get Key Changes In Kyc Norms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Key Changes In KYC Norms online

This guide is designed to assist users in completing the Key Changes In KYC Norms form online. We will walk you through the essential steps required to ensure that your submission is accurate and compliant with the latest regulations.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to obtain the necessary form and access it in your preferred document editor.

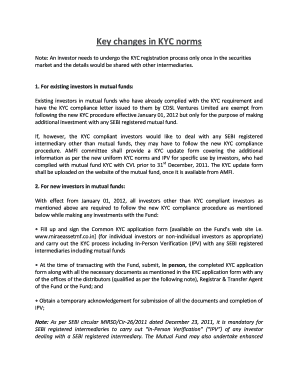

- For existing investors in mutual funds, verify if you possess the KYC compliance letter issued by CDSL Ventures Limited, as this exempts you from following the new KYC procedure when making additional investments with SEBI registered mutual funds.

- If you wish to deal with any SEBI registered intermediary other than mutual funds, you must follow the new KYC compliance procedure. Ensure to check the AMFI committee's website for the KYC update form once it becomes available.

- For new investors in mutual funds, begin by filling out the Common KYC application form, which is available on the fund’s website. Be sure to tailor it according to whether you are an individual or a non-individual investor.

- Submit the completed KYC application form along with all necessary documents in person to any SEBI registered intermediary's offices, including those of mutual funds or their Registrar & Transfer Agent.

- Obtain a temporary acknowledgment upon submission of your documents, confirming the completion of the In-Person Verification (IPV) process.

- Once documented verification is completed by a KRA, you will receive a letter within 10 working days either confirming your KYC compliance or indicating any deficiencies.

- Based on the temporary or final acknowledgment received, you do not need to repeat the KYC process with other intermediaries when making further investments.

- If you choose to submit a new KYC form along with an investment application, ensure it is combined with purchase, additional purchase, switch, SIP mandate form, or STP mandate form, not submitted standalone.

- For those with existing mutual fund investments not compliant with KYC, you can submit the new uniform KYC form while quoting your folio number.

Complete your KYC documentation online to ensure compliance and facilitate smooth transactions.

Related links form

This is often referred to as the three components or pillars of KYC, and involves: Customer Identification Program (CIP) Customer Due Diligence (CDD) Ongoing Monitoring.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.