Loading

Get New Development In Income Tax Tds Rules Changed ,form 16a ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the new development in income tax TDS rules changed, form 16A online

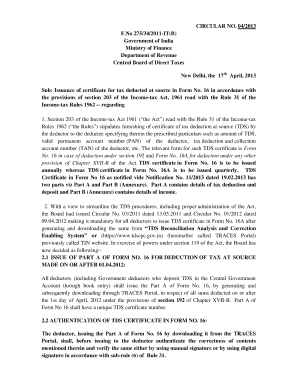

This guide provides a detailed overview of how to complete the new development in income tax TDS rules changed, form 16A online. By following these instructions, users can ensure accurate submission and compliance with tax regulations.

Follow the steps to fill out form 16A effectively.

- Click ‘Get Form’ button to access the form and open it in your online editor.

- Review the introductory section of the form. Ensure you understand the purpose, which is to provide a certificate for tax deducted at source for various payments.

- Fill out the details in Part A, including your tax deduction and collection account number (TAN) and the valid permanent account number (PAN) of the deductee.

- Complete the remainder of Part A by entering the total amount of TDS deducted and the assessed income in the appropriate fields.

- After completing Part A, prepare Part B manually, which includes specific income details. Ensure accuracy in your entries.

- Authenticate the completed forms using a manual or digital signature, as required. Verify that all details are correct before issuing.

- Finalize your form by saving the changes. You may also download or print the form for your records.

Start filling out your form 16A online today to ensure compliance with the new TDS rules.

Form 16A is a certificate issued under section 203 of the Income Tax Act, 1961, to the person who has deducted tax at source (TDS) on certain payments other than salary such as interest, commission, rent, etc. Form 16A contains details of the TDS deducted and deposited with the government on behalf of the deductee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.