Loading

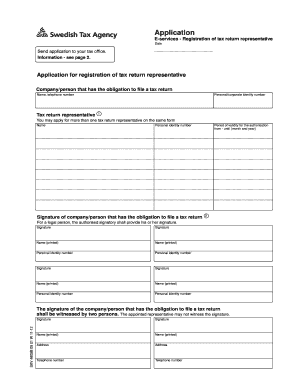

Get Skv 480909b W Utg Va 9, Application, E-services ... - Skatteverket

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SKV 480909B W Utg Va 9, Application, E-services ... - Skatteverket online

Completing the SKV 480909B W Utg Va 9 form for registering a tax return representative is essential for ensuring compliance with tax regulations. This guide will provide you with a clear, step-by-step process to navigate the online application effectively.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to acquire the form and open it in your editing platform.

- Provide the name and telephone number of the company or individual responsible for filing a tax return. Make sure to input accurate information to avoid future complications.

- Designate the tax return representative. Enter their name and personal or corporate identity number in the respective fields. If applying for multiple representatives, you can list them on the same form.

- Indicate the period of validity for the authorization by filling in the start and end months and years. If left blank, the authorization will remain in effect until further notice.

- Gather signatures as required. The authorized representative and the representative's authorized signatory must each provide their signature, printed name, and personal identity number.

- Ensure that two witnesses sign the document. Note that the appointed representative cannot witness their own signature.

- Double-check all entered information for accuracy. Ensure all required signatures and printed names are included.

- Once completed, you can save the changes made to the form, and choose to download, print, or share the document as necessary.

Complete your application online today to ensure timely processing and compliance.

VAT Sweden Rates by goods and services The standard VAT rate is 25%. The standard VAT rate generally applies for all goods and services for which no exemption, 0% or one of the reduced VAT rates is foreseen. The first reduced VAT rate is 12%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.