Loading

Get 4(2) It

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4(2) IT online

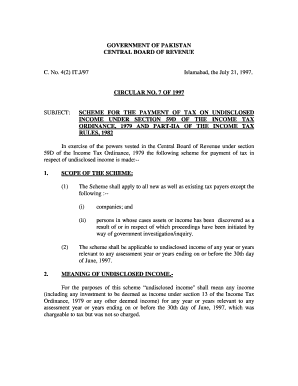

Filling out the 4(2) IT form can be a straightforward process. This guide provides detailed steps to help users complete the form accurately and efficiently, ensuring compliance with the relevant tax regulations.

Follow the steps to successfully complete the 4(2) IT online.

- Press the ‘Get Form’ button to retrieve the document and open it in your preferred editing platform.

- Begin by filling out your basic information at the top of the form, including your name, National Tax Number (NTN), and any relevant identification numbers such as your National Identity Card number (NIC).

- Provide your business address along with your contact details including telephone or fax numbers. Ensure all of this information is accurate to avoid any delays in processing.

- Indicate your status by selecting the applicable category, such as Individual, Association of Persons (AOP), Hindu Undivided Family (HUF), or Firm. Only one option should be marked.

- Detail the particulars of your undisclosed income or assets for each assessment year. List items such as cash, bank deposits, bullion, jewelry, shares, immovable property, and any other applicable assets.

- For each assessment year, provide the year in which the income was earned or the assets were acquired. Make sure to document all required years clearly.

- Summarize the total value of undisclosed income or assets. This should be a detailed breakdown, reflecting the actual values accurately.

- Calculate the tax payable at the rate of 7.5% based on your total disclosed income or assets. Include the method of payment such as challan, pay order, or demand draft, along with the date and bank details where applicable.

- Complete the verification section, providing a declaration that all information is correct and complete to the best of your knowledge. Sign, date, and indicate the place.

- Once all fields are completed, review the form for accuracy. Save your changes, and you can also download or print the form for your records.

Complete your 4(2) IT forms online today to ensure compliance and a smooth tax process.

0:00 7:14 So 5 to the third power means five times five times five. And if you actually do the multiplicationMoreSo 5 to the third power means five times five times five. And if you actually do the multiplication out five times five is 25. Times 5 again is 125 so 5 to the third power equals 125.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.