Loading

Get Repayment Of Customs Duties And Refund Of ... - Softax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

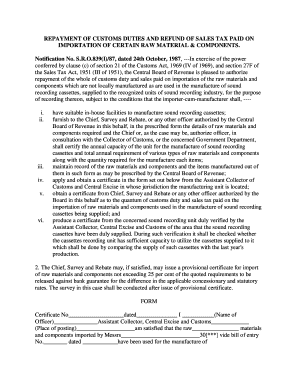

How to fill out the REPAYMENT OF CUSTOMS DUTIES AND REFUND OF ... - Softax online

This guide provides a comprehensive overview of how to complete the REPAYMENT OF CUSTOMS DUTIES AND REFUND OF ... - Softax form. By following these clear and detailed instructions, users can efficiently navigate the online submission process.

Follow the steps to fill out the form online:

- Click ‘Get Form’ button to obtain the form and open it in the designated editing platform.

- Begin by entering your personal information in the required fields, including your name, contact details, and business information.

- Next, provide the details of the customs duties and sales tax that you are claiming a refund for. Be sure to include all relevant bill of entry numbers and dates.

- Clearly outline the raw materials and components imported, along with specifying the items manufactured from these materials.

- Upload any required supporting documents that showcase your compliance with the applicable conditions, such as certificates from relevant authorities.

- Review all entered information for accuracy and completeness. Ensure that all fields are filled out correctly to avoid processing delays.

- Once all sections are completed, save your changes, and you can proceed to download, print, or share the form as needed.

Complete your forms online today for a seamless experience.

2. Refund. "Refund" here means that a Customs duty that has been paid is returned all or in part to the person who paid it, provided conditions in the Customs Tariff Law are satisfied.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.