Loading

Get Withholding Tax (sindh) - Softax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withholding Tax (Sindh) - Softax online

Filling out the Withholding Tax (Sindh) - Softax form online can streamline your tax management process and ensure compliance with local regulations. This guide will walk you through each step, providing detailed instructions tailored to both experienced users and those new to the process.

Follow the steps to complete the Withholding Tax (Sindh) - Softax form online effectively.

- Press the ‘Get Form’ button to retrieve the form and open it in a digital format for editing.

- Begin by entering the details of the withholding agent in the relevant fields such as name, category, and contact information. Ensure that the information is accurate and complete.

- Specify the status of the service provider by selecting either 'Registered' or 'Unregistered' as applicable. This distinction is crucial for determining the sales tax withholding process.

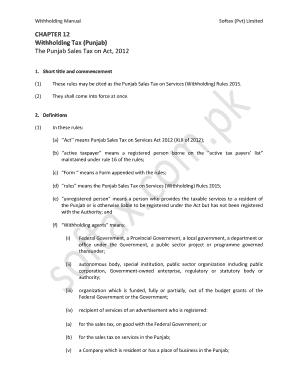

- Fill in the period for which the withholding tax is being filed, and provide the serial number, name of the service provider, and their corresponding tax identification numbers.

- For each service provided, accurately describe the services involved, including the number and date of tax invoices or commercial invoices.

- Input the value of services received, excluding sales tax, and the amount of Punjab sales tax invoiced or involved.

- Calculate the amount of Punjab sales tax that has been withheld and enter this figure in the designated field.

- Once all fields are completed, review the information for accuracy before certifying the form with your verification details, including your name, CNIC, designation, and signature.

- Finally, save your changes, and you have the option to download, print, or share the completed form as needed.

Complete your forms online today and ensure timely compliance with tax regulations.

General rate of Sindh sales tax on services is 15% with the exception of telecommunication services, which are liable to be taxed at 19.5%. Tax is levied at reduced or concessionary rates in certain cases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.