Loading

Get Sec Rule 701 Sellers Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SEC Rule 701 Sellers Letter online

This guide provides a clear and concise walkthrough for completing the SEC Rule 701 Sellers Letter online. Designed for users with varying levels of experience, this resource will help you navigate each section of the form efficiently and accurately.

Follow the steps to complete the SEC Rule 701 Sellers Letter effectively.

- Click ‘Get Form’ button to obtain the SEC Rule 701 Sellers Letter and open it in your preferred online document editor.

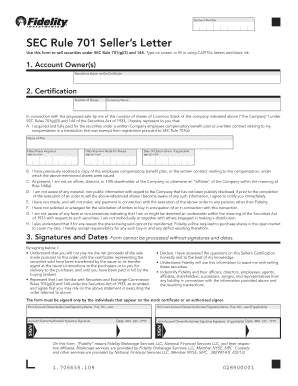

- In the first section, fill out the account owner(s) information. This should include the full names as shown on the certificate. Make sure to use CAPITAL letters for clarity.

- Proceed to the certification section. Here, you will indicate the number of shares you are selling and the company name. Ensure that the details match the information provided in your employee compensatory benefit plan.

- Within the same section, complete the statements confirming your acquisition of the shares. Provide the name of the plan, date of shares acquired, date payment made for shares, and date of option grant if applicable, using the specified date format.

- Acknowledge that you have received the employee compensatory benefit plan copies and confirm your current status as not being an officer, director, or 10% shareholder of the company, as per Rule 144(a).

- Review and confirm each of the certification statements listed. This includes your knowledge of material non-public information and responsibilities related to the sale and any obligations you accept.

- Sign and date the form in the signatures and dates section. Remember, the form cannot be processed without these signatures. Ensure each account owner or authorized signer completes this step.

- Once all sections are filled out and signed, you can save your changes, download, print, or share the completed SEC Rule 701 Sellers Letter as needed.

Start completing your SEC Rule 701 Sellers Letter online today to facilitate your securities sale.

Rule 701 exempts certain sales of securities made to compensate employees, consultants and advisors. This exemption is not available to Exchange Act reporting companies. A company can sell at least $1 million of securities under this exemption, regardless of its size.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.