Loading

Get Usffa 2nd Mortgage Program 2nd Mortgage Application 2011 ... - Usffa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USFFA 2nd Mortgage Program 2nd Mortgage Application 2011 online

This guide provides a comprehensive overview of how to complete the USFFA 2nd Mortgage Program 2nd Mortgage Application for the 2011 academic year online. By following the steps outlined below, you will navigate the application efficiently and ensure all necessary information is supplied.

Follow the steps to fill out the application accurately

- Locate and press the ‘Get Form’ button to retrieve the application form and open it in your preferred editor.

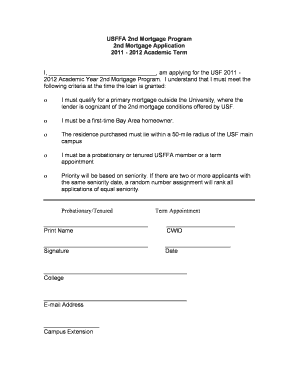

- Begin by entering your full name in the designated field where it states 'I, _________________________________, am applying for the USF 2011 2012 Academic Year 2nd Mortgage Program.' Make sure to provide your name exactly as it appears in official documents.

- Next, review the eligibility criteria outlined in the application. Ensure that you qualify for a primary mortgage outside the University and meet the required conditions for the loan.

- Confirm that you are a first-time Bay Area homeowner. This is critical to your eligibility for the program.

- Indicate that the residence you are purchasing is within a 50-mile radius of the USF main campus through the designated section.

- Select your employment status by marking the appropriate box for either probationary/tenured or term appointment. This information is vital for your application ranking.

- Print your name again in the space provided and enter your Campus Wide ID (CWID). Ensure your details are accurate.

- Affix your signature in the appropriate field along with the date to certify your application.

- Fill in your college, email address, and campus extension in the respective sections, ensuring all information is up-to-date.

- Once all sections are completed, review the form for accuracy. You can then save your changes, download, print, or share the completed application.

Complete your USFFA 2nd Mortgage Program 2nd Mortgage Application online today to secure your opportunity.

Higher Interest Rates Second mortgages usually have higher interest rates than first mortgages. This is because lenders see them as riskier. The higher the risk, the higher the rate. These increased rates mean higher monthly payments for borrowers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.