Loading

Get Sa1235 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SA1235 online

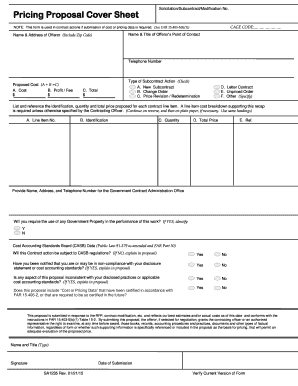

The SA1235 is a critical form used in contract actions where submission of cost or pricing data is required. This guide provides comprehensive, step-by-step instructions for filling out the SA1235 online, ensuring that every user understands the process clearly.

Follow the steps to fill out the SA1235 effectively.

- Press the ‘Get Form’ button to access the SA1235 form and open it in your document editor.

- Complete the 'Solicitation/Subcontract/Modification No.' field by entering the relevant identification number for your submission.

- Fill in the 'CAGE CODE' section with your unique identifier, consisting of five characters.

- In the 'Name & Title of Offeror’s Point of Contact' field, provide the full name and job title of the person who can be contacted regarding the proposal.

- Complete the 'Name & Address of Offeror (Include Zip Code)' section with your organization's complete address.

- Enter the 'Telephone Number' where you can be reached.

- In the 'Proposed Cost' section, breakdown your costs: fill in 'A. Cost', then 'B. Profit / Fee', and their sum in 'C. Total'.

- Select the appropriate 'Type of Subcontract Action' by checking one of the options: New Subcontract, Change Order, Price Revision / Redetermination, Letter Contract, Unpriced Order, or Other.

- Provide details for each contract line item in the listed fields: 'Line Item No.', 'Identification', 'Quantity', 'Total Price', and 'Ref.' Ensure to include a line item cost breakdown unless specified otherwise.

- Include the 'Name, Address, and Telephone Number for the Government Contract Administration Office'.

- Indicate whether you will require the use of any Government Property by checking 'Yes' or 'No'.

- Answer the Cost Accounting Standards Board (CASB) Data questions accurately, based on your circumstances.

- Ensure to type the 'Name and Title', add your 'Signature', and enter the 'Date of Submission'.

- Finally, save your changes, and choose to download, print, or share the completed form as needed.

Complete the SA1235 online to ensure your proposal is submitted accurately and efficiently.

Form 8979 should be filed with the IRS at the address specified in the form’s instructions. Make sure to double-check the details, as mailing it to the correct location is essential for timely processing. You might want to send it via certified mail for peace of mind. For additional help with deadlines and requirements, turn to the resources available through US Legal Forms and SA1235.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.