Loading

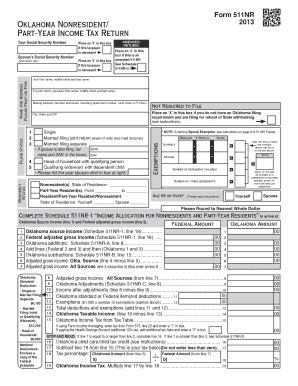

Get Includes Form 511nr (nonresident And Part-year Resident Return) 2012 Oklahoma Individual Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Includes Form 511NR (Nonresident And Part-Year Resident Return) 2012 Oklahoma Individual Income Tax online

Filing your Oklahoma tax return as a nonresident or part-year resident can be straightforward with the proper guidance. This guide outlines how to effectively complete the Includes Form 511NR, ensuring you provide accurate information in your online submission.

Follow the steps to fill out the Includes Form 511NR online.

- Press the 'Get Form' button to obtain the Includes Form 511NR, and open it in your preferred online editor.

- Begin by entering your personal details, including your name and Social Security Number, in the designated fields at the top of the form.

- Indicate your residency status by checking the appropriate box (Nonresident or Part-Year Resident). For joint filers, include your spouse’s information.

- Complete Schedule 511NR-1 to determine your Oklahoma Source Income and Federal Adjusted Gross Income (AGI).

- List any Oklahoma additions and subtractions as specified in Schedule 511NR-A and Schedule 511NR-B. Make sure to attach relevant documentation.

- Calculate your Oklahoma taxable income by subtracting your total deductions from your income after adjustments.

- Refer to the Oklahoma Income Tax Table to determine your tax based on the calculated taxable income.

- Fill out any additional fields regarding credits or payments made, such as Oklahoma withholding, estimated tax payments, or other credits.

- Finally, review your entries for accuracy, save the completed form, and prepare to submit your tax return online. Choose whether to save or print a copy for your records.

Don't forget to file your tax documents online and ensure you receive any applicable refunds quickly.

Who must file. You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.