Loading

Get Pt Mod. 24-rfi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PT MOD. 24-RFI online

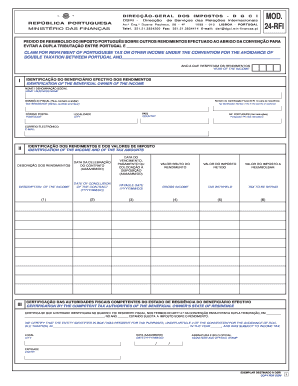

This guide provides a comprehensive overview of how to complete the PT MOD. 24-RFI form online for claiming repayment of Portuguese tax on other income. The instructions are designed to assist users of all experiences, ensuring a smooth filing process.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Box I, which requires identifying information about the beneficial owner of the income. Fill in your name or business name, tax identification number (NIF) in your country of residence, tax residence address, postcode, country, city, and optionally your email address. Ensure all entries are accurate and complete.

- Proceed to Box II to identify the income and tax amounts. Detail the description of the income, date of contract conclusion, payment date, gross income amount, tax withheld, and tax to be refunded. All values should be expressed in euros.

- In Box III, leave space for the certification from the competent tax authorities of your state of residence regarding your tax residency.

- Fill out Box IV by responding to yes/no questions that pertain to your tax situation. Provide necessary details if applicable.

- Complete Box V, which requires the entity responsible for withholding tax in Portugal to confirm about the income earned and tax withheld. Ensure all fields are filled correctly.

- If a legal representative is involved, Box VI must be filled to identify them, ensuring that this step is only taken if that representative will be submitting the form.

- Finally, in Box VII, the beneficial owner or their legal representative should sign the statement confirming all information provided is accurate. Indicate the date and location of signing.

- Once all sections are complete, review the form for accuracy, save your changes, and proceed to download, print, or share the form if necessary.

Complete your PT MOD. 24-RFI filing online today to ensure a timely and accurate tax repayment process.

Mod 21-RFI: Double Taxation Relief. The Portuguese tax authorities can insist Portuguese companies withhold 25% of the payment, when they are paying invoices submitted by British companies who have sold them goods or services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.