Loading

Get Import Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Import Requirements online

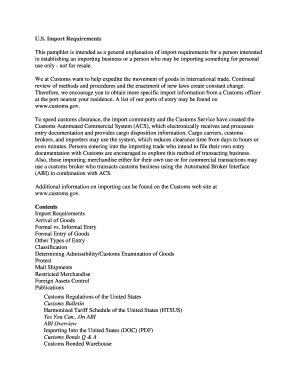

This guide provides comprehensive instructions for completing the Import Requirements form online. Whether you are starting an importing business or importing goods for personal use, following these steps will help ensure a smooth submission process.

Follow the steps to fill out the Import Requirements form with ease.

- Press the ‘Get Form’ button to access the Import Requirements form and open it in your document editor.

- Fill in your importer number. This is your IRS business registration number or, if you do not have a business, your social security number.

- Declare the dutiable value of your merchandise. Use the transaction value as the primary basis, which is the price you paid or are obligated to pay for the goods, including relevant costs like packing and commissions.

- Determine the classification number for your merchandise. Consult the Harmonized Tariff Schedule to find the appropriate classification that corresponds to your product type.

- Calculate and pay any estimated duties and processing fees applicable to your goods based on the classification number. Ensure to review the various rates applicable, including general and special rates.

- If necessary, post a surety bond for formal entries. This step is critical for ensuring compliance with customs requirements.

- Ensure that your goods meet all admissibility requirements, including proper labeling and safety standards, prior to their arrival in the United States.

- Complete any additional documents required for the import process, such as the bill of lading and commercial invoice, and submit these along with the Import Requirements form.

- Finally, review your filled-out form for accuracy, save your changes, and download, print, or share the form as necessary.

Start completing your Import Requirements form online today to ensure hassle-free importing!

List of Documents Required for Imports Customs Clearance Bill of Entry. Commercial Invoice. Bill of Lading or Airway Bill. Import License. Certificate of Insurance. Letter of Credit or LC. Technical Write-up or Literature (Only required for specific goods) Industrial License (for specific goods)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.