Loading

Get Decedentinsured (to Be Filed By The Executor With Form 706, United States Estate (and

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DecedentInsured (To be filed by the executor with Form 706, United States Estate) online

Filling out the DecedentInsured form is an essential step in the estate tax process. This guide will provide a clear and detailed overview of how to complete this form accurately to ensure compliance with tax laws.

Follow the steps to fill out the DecedentInsured form accurately

- Click ‘Get Form’ button to obtain the form and open it in your editor. Make sure to have all necessary documentation ready before proceeding.

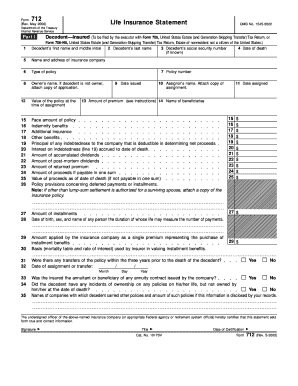

- Begin by entering the decedent's first name and middle initial at line 1, followed by their last name in line 2 and the social security number in line 3.

- Input the date of death in line 4, if known, followed by the name and address of the insurance company at line 5.

- Enter the type of policy on line 6 and the policy number on line 7. Document the date the policy was issued on line 9.

- If the decedent is not the owner of the policy, provide the owner's name in line 8 and include a copy of the application.

- For assignment details, fill in the assignor's name at line 10 and the date of assignment at line 11. Attach a copy of the assignment.

- Complete lines 12 to 24 with the policy's monetary values, such as the value at time of assignment, amount of premium, and beneficiary details.

- Record any additional benefits or deductions related to the insurance policy in the respective lines from 15 to 25.

- Confirm whether there were any transfers of the policy within the three years prior to death by responding to line 32.

- In the certification section, ensure you have the insurance company official’s signature and date on the document.

- Once all sections are filled out, review the information for accuracy. Save your changes, and consider downloading, printing, or sharing the form as needed.

Ensure your documents are completed and submitted online for a smoother process.

The fees you are paid as a personal representative, executor, or Administrator of an estate are treated as taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.