Loading

Get Schedule J, Form N-40, Rev. 2005, Trust Allocation Of An ... - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule J, Form N-40, Rev. 2005, Trust Allocation Of An Accumulation Distribution online

This guide provides a comprehensive overview of how to complete the Schedule J, Form N-40, Rev. 2005, online. It offers clear and structured steps to help you navigate the form effectively.

Follow the steps to successfully complete the Schedule J form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

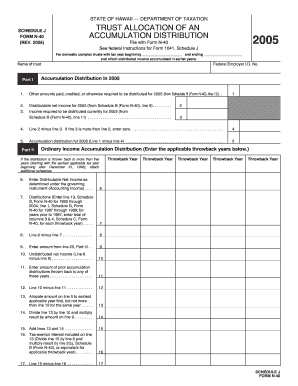

- Enter the name of the trust and its Federal Employer I.D. Number at the top of the form.

- In Part I, provide the accumulation distribution amounts for the year 2005, including any amounts paid, credited, or required to be distributed, as specified in the corresponding fields.

- Calculate the distributable net income for 2005 as instructed, using information from Schedule B of Form N-40.

- Complete calculation lines by subtracting necessary values as indicated, ensuring to enter zero if appropriate, particularly when line three exceeds line two.

- In Part II, detail ordinary income accumulation distribution and throwback years, entering the required distributions and calculations as per your records.

- For each throwback year, accurately calculate the amounts required in subsequent lines and make sure to reference any needed additional schedules.

- In Part III, you will report taxes imposed on the undistributed net income by completing the relevant fields accurately with the collected data.

- Allocate amounts to beneficiaries in Part IV, providing their names, identifying numbers, and shares from calculated amounts in the previous sections.

- Once you have entered all necessary information, ensure to review for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Start filling out your documents online today.

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.