Loading

Get Fm Lihtc Annual Rpt-owners Cert. Lihtc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fm LIHTC Annual Rpt-Owners Cert. LIHTC online

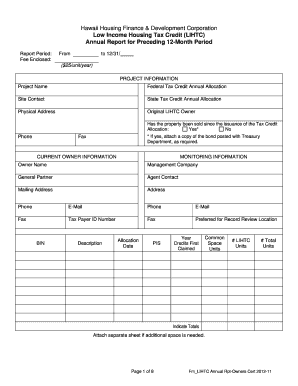

Filling out the Fm LIHTC Annual Rpt-Owners Cert. LIHTC online is an essential task for property owners participating in the Low Income Housing Tax Credit program. This guide offers step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the report period, including the start and end dates. Ensure that you include the fee enclosed based on the unit count.

- Fill out the project information section, including the project name, federal and state tax credit allocations, site contact, and physical address.

- Provide current owner information, including owner name, management company, general partner, mailing address, phone number, email, and taxpayer ID number.

- In the occupancy information section, indicate the minimum set-aside percentage and whether there has been any change in the number of LIHTC units since last year.

- Complete the rent-up activity section by entering specific numbers related to applicants on the waiting list and those who have been placed.

- In the rental information section, input the qualifying maximum tenant contribution and details about unit types, maximum rents, and utility allowances.

- Address annual recertification procedures by indicating whether a self-certification of annual income form is being used.

- Complete the owner's certificate of continuing program compliance section, checking relevant boxes as necessary based on your project’s compliance status.

- Finally, review the entire form for completeness, attach any required supporting documentation, and ensure you have not omitted any vital information.

- Once satisfied, save your changes, download the completed form for your records, and print or share the form as needed.

Get started on completing your Fm LIHTC Annual Rpt-Owners Cert. LIHTC online today!

Check if you qualify for CalEITC You're at least 18 years old or have a qualifying child. Have earned income of at least $1.00 and not more that $30,950. Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for you, your spouse, and any qualifying children.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.