Loading

Get Your Mortgage Financing Needs Analysis - Your Solution To Home ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Your Mortgage Financing Needs Analysis - Your Solution To Home ... online

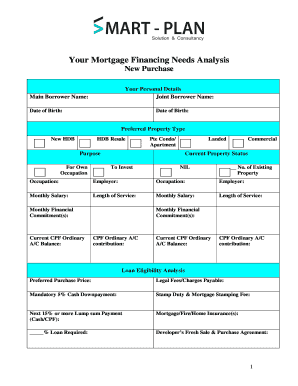

Completing the Your Mortgage Financing Needs Analysis form is an essential step in assessing your mortgage financing needs. This guide provides clear and supportive instructions to help you fill out the form accurately and efficiently.

Follow the steps to successfully complete your mortgage financing needs analysis

- Click 'Get Form' button to access the form online and open it in your preferred digital platform.

- Begin by filling in your personal details. Enter the main borrower's name, date of birth, and joint borrower's name and date of birth if applicable. Ensure that all personal information is accurate.

- Specify your preferred property type by selecting from options such as new HDB, HDB resale, private condo/apartment, landed property, or commercial.

- Indicate the purpose of your property acquisition. Options may include 'for own use' or 'to invest'.

- Provide details about your occupation and employer information for both the main borrower and joint borrower, along with their monthly salaries and length of service.

- List any existing monthly financial commitments. This includes your current CPF ordinary account balance and contributions, ensuring all financial details are up-to-date.

- In the loan eligibility analysis section, fill in your preferred purchase price, legal fees and charges payable, and details of cash downpayment and stamp duty.

- Complete the mortgage section by selecting your preferred banks or financial institutions. Review the types of interest rates you are considering.

- Evaluate the features of a housing loan provided in the document, and ensure you understand lock-in periods, cancellation fees, and other important terms.

- Finally, review all the information you have entered. After verifying its accuracy, proceed to save changes, download, print or share the form as needed.

Take the next step towards your home financing needs by completing the analysis online today.

Related links form

Red Flag #1: When they offer you a rate that's lower than the APR. When a mortgage's APR is much higher than the actual rate, it means that the fees are a lot higher, too - and you'll be paying them over the life of your loan. A low rate might be enticing, but you have to consider the long-term cost.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.