Loading

Get Canada Td1ab E - Alberta 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada TD1AB E - Alberta online

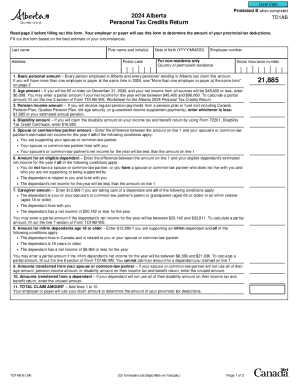

The Canada TD1AB E - Alberta is an essential form that helps individuals determine their provincial tax deductions in Alberta. This guide provides clear and comprehensive steps for filling out the form online, ensuring users can complete it accurately and confidently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your last name and first name along with any initials in the provided fields. Next, fill out your date of birth in the format YYYY/MM/DD, and provide your postal code.

- Include your social insurance number where prompted and, if you are a non-resident, list your country of permanent residence.

- Move on to the 'Basic personal amount' section, and indicate if you are claiming this amount which is available to all employed individuals in Alberta.

- For the 'Age amount', enter $6,099 if you will be 65 or older by December 31, 2024, and if your anticipated net income is $45,400 or less. If your income falls between $45,400 and $86,060, you can enter a partial amount, calculated using Form TD1AB-WS.

- In the 'Pension income amount' section, report either $1,685 or your estimated annual pension if applicable.

- Claim the 'Disability amount' of $16,882 if you are eligible and plan to use Form T2201 for the Disability Tax Credit Certificate.

- If you support a spouse or common-law partner, fill out the 'Spouse or common-law partner amount' by indicating the difference between the basic amount and your partner's estimated income.

- For the 'Amount for an eligible dependant', describe conditions where you can claim this if you do not have a supporting partner.

- Complete the 'Caregiver amount', specifying the amount claimed if applicable, and ensure to provide the necessary details about the dependant's income.

- Finally, total up lines 1 through 10 to arrive at your claim amount, which your employer will use to calculate provincial tax deductions.

- Once you have filled out all appropriate fields, review your information for accuracy, sign and date the form, and then submit it to your employer or payer.

Start filling out the Canada TD1AB E - Alberta form online today to ensure your tax deductions are accurate!

You don't have to complete the form every year, only when your situation changes. You only have 7 days after the change to submit a new form to your employer. If your employer does not have a TD1 form for you, he will make deductions allowing only for the basic personal amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.