Loading

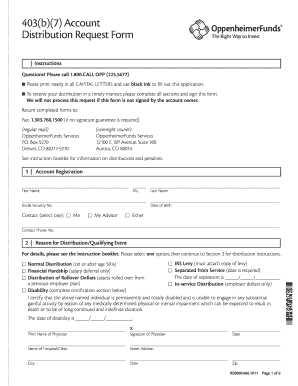

Get Oppenheimerfunds 403(b)(7) Distribution Form Instruction Booklet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet online

Filling out the OppenheimerFunds 403(b)(7) Distribution Form can be a straightforward process with the right guidance. This comprehensive guide aims to provide clear and detailed instructions to ensure that users can effectively complete the form online.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the distribution form, which will be opened in your selected editor.

- Begin with Section 1: 'Account Registration.' Fill out all fields completely, providing your first name, last name, middle initial, social security number, date of birth, and a contact person's information.

- Next, proceed to Section 2: 'Reason for Distribution.' Select an appropriate qualifying event that validates your distribution request.

- In Section 3: 'Type of Distribution,' choose the type of distribution you are requesting, whether it’s a one-time distribution, ongoing systematic payments, or dividends and capital gains.

- Move to Section 4: 'Tax Withholding Election.' Decide on the federal and state tax withholding options relevant to your situation, ensuring you understand mandatory withholdings.

- Complete Section 5: 'Method of Payment.' Indicate how you want to receive your distribution, whether via bank account transfer or check, ensuring you include any necessary banking information.

- In Section 6: 'Signature,' sign the form to authorize your distribution request. Remember that unsigned forms will not be processed.

- Review your entries for accuracy. If required, obtain any necessary signatures or guarantees for high-value distributions.

- Once all sections are completed and accurate, save your changes, download the form, or print it for mailing or faxing to OppenheimerFunds Services.

Take the next step in managing your retirement funds by completing the OppenheimerFunds 403(b)(7) Distribution Form online today.

The 5-year rule for 403b plans states that distributions must be taken within five years of your first contribution or the year you change jobs. This rule impacts how and when you withdraw your funds. For more clarity on the implications of the 5-year rule, consult the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.