Loading

Get Oneida Casino Win/loss Statement Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oneida Casino Win/Loss Statement Request Form online

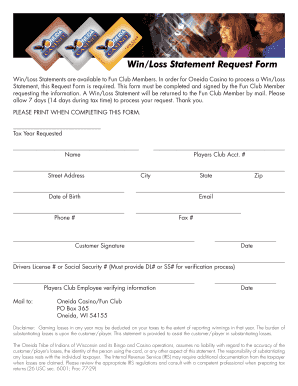

Filling out the Oneida Casino Win/Loss Statement Request Form is a straightforward process that ensures you can obtain your win/loss statements as a Fun Club Member. This guide will walk you through each section of the form to make your online experience efficient and trouble-free.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the tax year you are requesting by filling in the corresponding field.

- Provide your full name in the designated section to ensure accurate identification.

- Enter your Players Club Account Number, which can be found on your membership card.

- Fill in your street address, city, state, and zip code for proper mailing of the statement.

- Input your date of birth to verify your identity.

- Provide your email address where you can receive notifications.

- Enter your phone number for any follow-up communications.

- If applicable, provide your fax number in the space provided.

- Sign and date the form in the customer signature section, affirming that the information provided is accurate.

- Provide either your driver's license number or Social Security number for the verification process.

- A Players Club employee will need to verify your information before submission.

- Finalize the process by mailing the completed form to Oneida Casino/Fun Club at the specified address.

- Please allow approximately 7 days for processing, and 14 days during tax time.

Ready to get started? Complete your Oneida Casino Win/Loss Statement Request Form online today.

Related links form

You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.