Loading

Get Informal Trust Account Application - Scotiamcleod Mutual Fund ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Informal Trust Account Application - ScotiaMcLeod Mutual Fund online

Filling out the Informal Trust Account Application for ScotiaMcLeod Mutual Fund can seem daunting, but this guide aims to provide clear, step-by-step instructions to make the process easier. By following these instructions, users will be able to complete the application online with confidence.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to access the Informal Trust Account Application form. This will enable you to download the document and begin filling it out in your preferred format.

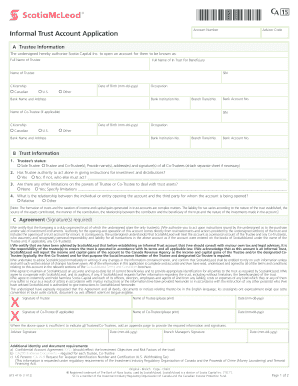

- Complete the 'Trustee Information' section by entering the full name of the trustee, the full name of the beneficiary, their Social Insurance Number (SIN), date of birth, citizenship, occupation, and bank details including bank account number, institution number, and branch transit number.

- If applicable, fill in the 'Co-Trustee Information' section with the same details for any co-trustee.

- In the 'Trust Information' section, specify the status of the trustee as either 'Sole Trustee' or 'Trustee and Co-Trustee(s)', and detail any limitations on the trustee's authority to act.

- Confirm the relationship between the trustee and the beneficiary by selecting the appropriate option (e.g., relative), and ensure to include any relevant details.

- Review the 'Agreement' section carefully. You are required to certify accuracy and provide your signature along with the co-trustee’s signature, if applicable. Always ensure that all parties involved understand the terms and conditions.

- Once all sections are completed, save your changes to the application. You may choose to print or download the completed form for your records, or share it as required.

Complete your Informal Trust Account Application online today to ensure a smooth and efficient process.

If a trust exists, the trust is treated as a separate taxpayer and will be subject to the tax rules for trusts. Generally, any income/losses and capital gains/losses earned in the in-trust account will be taxed in the trust unless the income or capital gains are paid or made payable to the beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.