Loading

Get Credit Application - The Credit Union

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Application - The Credit Union online

Completing the Credit Application for The Credit Union is a crucial step to obtain credit. This guide provides a comprehensive overview of each section of the form, ensuring you understand the information required and how to fill it out correctly online.

Follow the steps to successfully complete your credit application.

- Press the ‘Get Form’ button to access the Credit Application and open it in your preferred document editor.

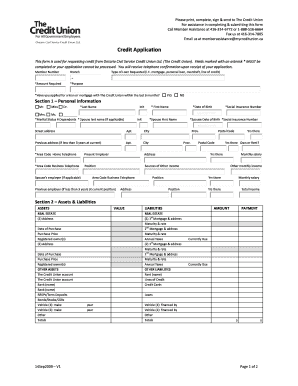

- Begin by entering your member number and branch information, if you have them. Then, indicate the type of loan you are requesting, such as a mortgage, personal loan, or line of credit.

- Fill in the amount required and specify the purpose of the loan. You must also disclose whether you have applied for a loan with The Credit Union within the last six months by selecting 'Yes' or 'No.'

- In Section 1, provide your personal information, including your last name, first name, date of birth, and social insurance number. Ensure to complete all fields marked with an asterisk (*) as they are mandatory.

- If applicable, fill out your marital status and dependent information. Include your spouse’s last name, first name, date of birth, and social insurance number, if relevant.

- Complete your address information, including your current street address and previous address if you have lived there for less than three years. Include contact numbers and employment details.

- In Section 2, list your assets and liabilities. Specify real estate ownership, mortgages, and any other financial obligations you may have. Ensure you provide the value of each asset and the amount due for liabilities.

- In Section 3, declare if you have claimed bankruptcy or filed a consumer proposal in the last seven years. Answer for both yourself and any joint applicant, if applicable.

- Indicate your preferred method of contact regarding the application, providing an email address or telephone number, along with the best times to reach you.

- Finally, review the authorization statements and sign the application. Ensure to record the date of signing as this is mandatory.

- Once you have filled out the form completely, save your changes. You can then download, print, or share the completed form as needed.

Begin your Credit Application online today and take the first step toward securing your loan.

You make an initial deposit — often between $500 – $1,000 — which the credit union holds in a secure account for an agreed-upon term. During that time, you make regular payments, which the credit union reports to the three main credit bureaus.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.