Loading

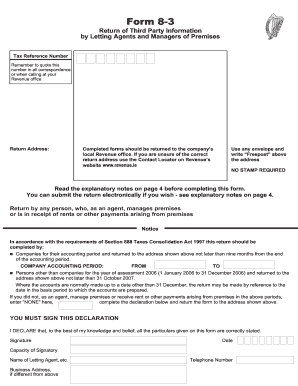

Get Form 8-3 - 2006 - Return Of Third Party Information By Letting Agents And Managers Of Premises

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8-3 - 2006 - Return of Third Party Information by Letting Agents and Managers of Premises online

Filling out the Form 8-3 - 2006 is essential for letting agents and managers of premises to report third-party information accurately. This guide provides a clear, step-by-step process to assist you in completing the form online.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering your Tax Reference Number accurately. This number is crucial and should be quoted in all correspondence related to your submission.

- Provide the completed form to your local Revenue office. If you are unsure of the correct return address, refer to the Contact Locator on Revenue’s website.

- Indicate if you have managed premises or received rent during the stated periods. If not, enter 'NONE', complete the declaration, and return the form.

- In the signature section, sign the declaration stating that all particulars are correctly stated.

- Fill in your name, position, and business address, ensuring these details are accurate.

- Complete the section for the letting property by including the full address and type of property, ensuring to tick the appropriate boxes.

- State the name of the owner, entering either the full title of the company or individual surname. If the property is jointly owned, enter the first named owner and tick the respective box.

- List the amount received as rent and indicate the frequency of payment, selecting the appropriate option.

- If there are other payments, please describe them and indicate the date the letting commenced.

- Once you have completed all fields, review the form for accuracy. After verifying all information, you may save changes, download, print, or share the form as necessary.

Proceed to complete your document online to ensure accurate submission.

Excluded. The following payments need not be included in the return: Payments totalling less than €6,000 per year to any one person. Payments for services in which the value of any goods provided as part of the service exceeds two-thirds of the total charge.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.