Loading

Get Accountant Report.doc. Image - Fitzsimonsfinance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Accountant Report.doc. Image - Fitzsimonsfinance online

This guide provides a step-by-step process for completing the Accountant Report form. By following these simple instructions, you can ensure that all necessary information is submitted accurately and efficiently.

Follow the steps to complete your Accountant Report.

- Press the ‘Get Form’ button to access the Accountant Report document and open it in your preferred online editor.

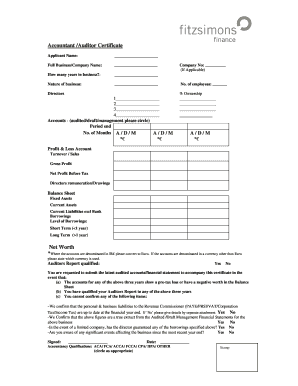

- Begin by entering your name in the 'Applicant Name' field. Ensure that it matches your official identification.

- Next, fill in the 'Full Business/Company Name' field with the registered name of your business. This should be the name as it appears in official records.

- Indicate how many years your business has been operating in the corresponding field. This provides context regarding your business's experience.

- Describe the nature of your business in the designated field. Clearly define the services or products you offer.

- If applicable, enter the company registration number in the 'Company No' field.

- State the number of employees currently working in your business. This figure helps in assessing the scale of your operations.

- Provide details about the directors of the company in the 'Directors' section, including their names and percentage of ownership.

- Indicate the type of accounts being submitted (audited/draft/management) by circling the appropriate option in the 'Accounts' section.

- Fill in the financial details under 'Profit & Loss Account' including turnover/sales, gross profit, net profit before tax, and directors' remuneration or drawings.

- Complete the 'Balance Sheet' section, including fixed assets, current assets, current liabilities excluding bank borrowings, and total borrowings. Specify the level of borrowings as short-term or long-term.

- Calculate and enter your net worth. Remember to convert any amounts from Irish pounds to Euros where applicable.

- If the accounts are denominated in a currency other than Euro, specify the currency used in the form.

- Indicate whether the auditors' report was qualified by selecting 'Yes' or 'No.' This reflects the auditors' assessment of your financial statements.

- Carefully read the statements regarding tax liabilities and financial conditions. Confirm each by circled 'Yes' or 'No' and provide additional details if necessary.

- Finally, sign and date the form in the designated areas. Ensure that your accountancy qualifications are clearly stated, circling the appropriate option.

- After completing all fields, save your changes, and consider downloading, printing, or sharing the form as needed to complete your submission.

Complete your Accountant Report online today and ensure your financial statements are accurately represented.

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.