Loading

Get Loan Application Form - St Colmcille's (kells) Credit Union - Kellscu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Application Form - St Colmcille's (Kells) Credit Union - Kellscu online

This guide provides a clear and supportive approach to filling out the Loan Application Form from St Colmcille's (Kells) Credit Union. By following these steps, users can ensure that they complete the application accurately and efficiently.

Follow the steps to complete your loan application form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

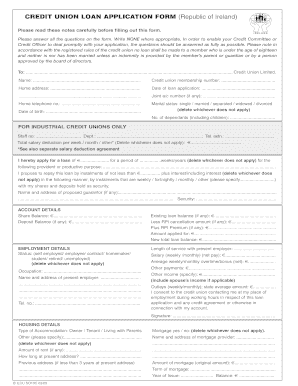

- Begin by filling out your personal information, including your name and credit union membership number. Also, provide your home address, date of loan application, and joint account number if applicable.

- Indicate your marital status by selecting the appropriate option and provide your date of birth along with the number of dependents.

- If applicable, enter your employee details, including staff number, department, and contact number. Provide your total salary deduction and complete the loan amount requested and the purpose of the loan.

- Detail your repayment proposal, including the amount you intend to repay and how often (weekly, monthly, etc.), along with the security for the loan.

- Fill in your account details, including your share balance and deposit balance, if any, which demonstrate your financial standing.

- Provide your employment details, selecting your status and occupation, and summarizing your employer's information, including address and contact number.

- Include details about existing loans and other income or outlays. Ensure that all amounts are accurate.

- Select the type of accommodation you have, whether you are a homeowner, tenant, or living with parents. Include mortgage information if it applies to your situation.

- If the loan is for site purchase, house purchase, or home improvements, provide detailed information about the work, costs, and payment plans.

- Complete the declarations regarding your health, creditors, and repayment protection. Make sure to sign and date the application.

- Finally, review your form for accuracy, save your changes, and complete your submissions. You may choose to download, print, or share the form as necessary.

Complete your loan application online today to get started on your financial journey.

Credit unions are not-for-profit financial institutions that require membership for their services as well as access to special deals and rates. Like banks, credit unions can take up to 7 business days to process a loan application, and another 7 business days may pass before they disburse your funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.