Loading

Get Chy2 - Scheme Of Tax Relief For Donations Of Money Or Designated Securities To Eligible Charities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHY2 - Scheme Of Tax Relief For Donations Of Money Or Designated Securities To Eligible Charities online

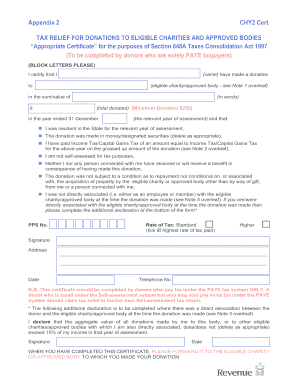

The CHY2 form allows donors who are solely PAYE taxpayers to claim tax relief on their donations to eligible charities or approved bodies. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to fill out the CHY2 form effectively.

- Press the ‘Get Form’ button to access the CHY2 form. This will open the document in your editor for completion.

- Begin by filling in your full name in block letters where indicated. Ensure that this information is clear and legible.

- Specify the name of the eligible charity or approved body to which you have made a donation. Refer to the relevant notes for eligibility confirmation.

- Enter the amount of the donation in figures, followed by the equivalent written amount in words.

- Indicate the year of assessment by entering the relevant year in the YYYY format.

- Confirm your residency status for the relevant year by checking the corresponding checkbox. Ensure this is accurate.

- Choose between money or designated securities for your donation by deleting as appropriate in the designated field.

- Verify that you have paid the necessary income tax or capital gains tax by signing where indicated. This certification is essential for claiming relief.

- Complete the signature field and provide your address and telephone number for any necessary follow-up.

- Finalize by entering the date of completion in the DD/MM/YYYY format.

- If applicable, complete the additional declaration regarding the direct association with the eligible charity or approved body.

- Upon completion, make sure to save your changes. You can download, print, or share the form as required before forwarding it to the eligible charity or approved body.

Complete your CHY2 form online today and ensure your charitable donations are recognized for tax relief.

If you donated a total (aggregate) amount of $500 or more in noncash donated property to charitable organizations or claim a deduction for donated property, use Form 8283 to report information about tax-deductible donations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.