Loading

Get My Section 50 (9)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MY Section 50 (9) online

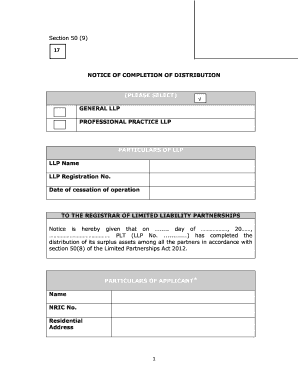

Filling out the MY Section 50 (9) form is an important step for Limited Liability Partnerships (LLPs) that have completed the distribution of their surplus assets. This guide provides a clear and supportive approach to completing the form online, ensuring you can navigate each section with ease.

Follow the steps to successfully complete the MY Section 50 (9) online

- Press the ‘Get Form’ button to access the MY Section 50 (9) form and open it in your preferred editor.

- Select the type of LLP by checking the appropriate box, either General LLP or Professional Practice LLP.

- Fill in the particulars of the LLP by entering the LLP name, LLP registration number, and the date of cessation of operation in the designated fields.

- In the section addressed to the Registrar of Limited Liability Partnerships, complete the notice by stating the completion date of the distribution of surplus assets and the LLP name along with the registration number.

- Provide the particulars of the applicant by inputting their name, NRIC number, residential address, mobile phone number, and email address. Ensure that the applicant is the same person who applied for the LLP voluntary winding up.

- Review the declaration statement, affirming that the facts and information contained in the document are true, followed by the applicant's signature, name, and date.

- Save your changes, and choose to download, print, or share the completed MY Section 50 (9) form as needed.

Complete the MY Section 50 (9) form online today to ensure your LLP is in compliance.

When completing your Form 1040, you should avoid leaving any fields blank. Instead, you should input zero if there is no applicable information for MY Section 50 (9). This practice helps prevent any confusion or delays during the tax filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.