Get Mx Los Impuestos Form 37 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MX Los Impuestos Form 37 online

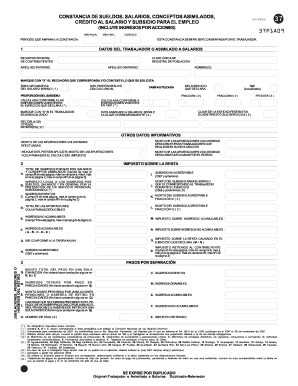

The MX Los Impuestos Form 37 is an essential document for individuals reporting various income types and tax-related deductions. This guide aims to provide a step-by-step approach to completing the form online, ensuring users can navigate each section with clarity and confidence.

Follow the steps to successfully complete the MX Los Impuestos Form 37 online

- Press the ‘Get Form’ button to access the form and open it in the digital editor.

- Begin by providing personal information in the 'Datos del Trabajador o Asimilado a Salarios' section, including your Federal Tax Registry and Unique Population Registry keys, last names, and first names.

- Indicate the income period by specifying the 'Mes Inicial' and 'Mes Final' along with the year.

- Mark with an ‘X’ the corresponding checkbox for the geographic area of the minimum wage and indicate the proportion of subsidies, if applicable.

- Provide details about your employer, including the Federal Tax Registry of other employers if you had multiple during the reporting period.

- Enter the total income and tax deductions in the 'Impuesto Sobre La Renta' section, ensuring correct calculations for salaries, subsidies, and any exemptions.

- Fill out sections concerning voluntary contributions made during the year, specifying any amounts that the employer applied in tax calculations.

- Review your entries for accuracy and completeness.

- Once completed, save changes, download, print, or share the form as required.

Complete your forms online today for a smoother filing experience!

Anyone earning income in a municipality with a RITA tax is required to file an Ohio RITA return. This includes both residents and non-residents who earn income from local sources. Knowing your obligations regarding MX Los Impuestos Form 37 can help avoid penalties or discrepancies.

Fill MX Los Impuestos Form 37

De los regímenes fiscales preferentes. Personas de 65 Años de Edad o Más, de 2024. Capture el importe de deducciones que procedan conforme a la Ley del Impuesto Empresarial a Tasa Única y que no haya capturado en los campos anteriores. TurboTax® es el software de preparación de impuestos de mayor venta para presentar impuestos en línea. Ciertos temas sobre los cuales un tribunal puede haber dictado un fallo más favorable para los contribuyentes. Sepa cómo conseguir copias en papel de los formularios para declarar impuestos federales y estatales, y cómo enviarlos por correo. Tienes ingresos, propiedades o familia en EE. UU.? Ciertos temas sobre los cuales un tribunal puede haber dictado un fallo más favorable para los contribuyentes. ¿Tengo que pagar impuestos? Residencia fiscal; ¿Cómo presentar mi declaración de impuestos?

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.