Get Form 990-bl (rev. October 1999), (fill-in Version)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990-BL (Rev. October 1999), (Fill-in Version) online

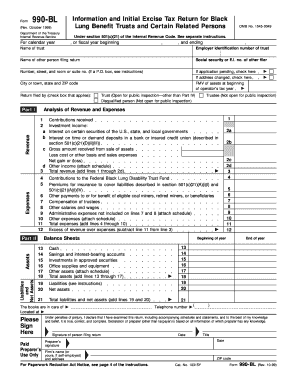

This guide provides a comprehensive overview on how to complete the Form 990-BL (Rev. October 1999), a critical document for Black Lung Benefit Trusts. Follow the detailed instructions to ensure accurate and efficient online filing.

Follow the steps to successfully complete your Form 990-BL online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Fill in the calendar or fiscal year information. Specify the beginning and ending dates of the tax year for which you are filing.

- Enter the name of the trust and its employer identification number (EIN) in the appropriate fields.

- Input the name and social security or Employer Identification number (EIN) of the other person filing the return.

- Provide the address details, including number, street, city, state, and ZIP code. Indicate if the address has changed.

- Fill in the fair market value (FMV) of assets at the beginning of the tax year in the designated section.

- Report total revenue by completing the sections for contributions received, investment income, and other relevant income details.

- Detail the expenses incurred during the year, including any contributions to the Federal Black Lung Disability Trust Fund.

- Calculate and enter the excess of revenue over expenses by subtracting total expenses from total revenue.

- Complete the balance sheet section by filling out the assets, liabilities, and net assets information.

- Sign the form, confirming that the information provided is accurate and complete. Include the date and any preparer's information if applicable.

- Once you have completed the form, save your changes. You may then download, print, or share the completed form as needed.

Begin your online filing process by completing your Form 990-BL today.

It contains questions about the filing organization's governing body (i.e., its board); whether the nonprofit has conflict of interest, whistleblower, document retention/destruction, and other policies in place; the procedures it follows for establishing executive compensation; and how it makes its public documents ( ... Highlights of IRS Form 990 jcfny.org https://jcfny.org › app › uploads › 2018/11 › form-990-... jcfny.org https://jcfny.org › app › uploads › 2018/11 › form-990-...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.