Loading

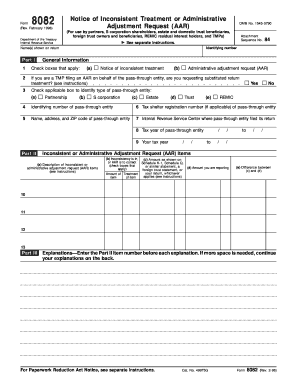

Get Form 8082 (rev. February 1998)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8082 (Rev. February 1998) online

Filling out Form 8082, also known as the Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR), can be crucial for addressing inconsistencies in tax filings. This guide offers step-by-step instructions to help you complete the form efficiently in an online format.

Follow the steps to complete Form 8082 accurately.

- Click the ‘Get Form’ button to acquire the form and open it for editing.

- Begin by entering the name(s) shown on your tax return in the designated field. Ensure the name matches exactly as it is on your return.

- In Part I, identify the type of pass-through entity by checking the appropriate box. Options include Partnership, S Corporation, Estate, Trust, or REMIC.

- Provide the identifying number for the pass-through entity, including the tax shelter registration number if applicable, in the relevant fields.

- Fill in the name, address, and ZIP code of the pass-through entity. This information is crucial for correct identification.

- Indicate the Internal Revenue Service Center where the pass-through entity filed its return and the tax year of the pass-through entity.

- In Part II, describe the inconsistent or administrative adjustment request items clearly. Use the boxes to indicate whether these items are related to Schedule K-1, Schedule Q, or similar statements.

- For each item in Part II, report the amount you are correcting and the corresponding difference between the reported amount and what is on your return.

- In Part III, provide detailed explanations for each item listed in Part II. Refer to the item number for clarity. If additional space is needed, continue your explanations on a new page.

- Once all information is accurately filled out, remember to save your changes to the form. You can then download, print, or share the completed form as needed.

Take the next step towards efficient document management and complete your forms online today.

Partners, S corporation shareholders, beneficiaries of an estate or trust, owners of a foreign trust, or residual interest holders in a real estate mortgage investment conduit (REMIC) file this form if they wish to report items differently than the way they were reported to them on Schedule K-1, Schedule Q, or a ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.