Loading

Get Cert-116, Exempt Petroleum Products Certificate. Exempt Petroleum Products Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CERT-116, Exempt Petroleum Products Certificate online

The CERT-116, Exempt Petroleum Products Certificate, is a crucial document used to establish that charges made by a distributor selling exempt petroleum products are not subject to the petroleum products gross earnings tax. This guide will provide you with clear and comprehensive instructions on filling out this certificate online.

Follow the steps to successfully complete the CERT-116 form.

- Click ‘Get Form’ button to obtain the form and open it in an editing platform.

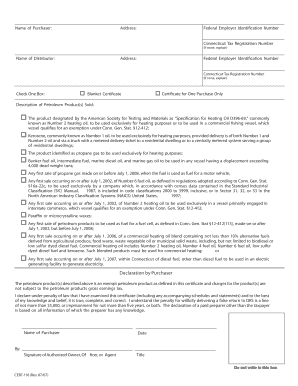

- Provide the name of the purchaser. This should be the individual or entity purchasing the exempt petroleum products.

- Enter the address of the purchaser. Ensure all information is accurate to avoid processing delays.

- Fill in the Federal Employer Identification Number (FEIN) and the Connecticut Tax Registration Number. If either is not applicable, provide an explanation.

- Input the name of the distributor. This is the individual or entity delivering the exempt petroleum products.

- Enter the address of the distributor, including any relevant contact information.

- Provide the distributor's Federal Employer Identification Number and Connecticut Tax Registration Number. Again, explain if either is not applicable.

- Select the appropriate box to indicate whether this is a Blanket Certificate or a Certificate for One Purchase Only. A Blanket Certificate covers a series of transactions over three years.

- In the description section, list the petroleum products being purchased. Accurately identify each product as defined in the certificate.

- Complete the declaration by the purchaser, affirming the information provided is true and accurate. This section includes the name, date, and signature of the authorized individual.

- After completing all sections, review the form for any errors. Once verified, save the changes, and download or print the completed certificate.

Complete your CERT-116, Exempt Petroleum Products Certificate online today to ensure compliance and avoid any potential tax issues.

Those businesses must pay a quarterly tax at the rate of 8.1% of gross earnings in each taxable quarter derived from the first sale of petroleum products in Connecticut. Under Conn. Gen. Stat § 12-587(c), any business other than those subject to and having paid tax under Conn.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.