Loading

Get Mutual Fund Application For New Accounts - Nationwide Financial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mutual Fund Application For New Accounts - Nationwide Financial online

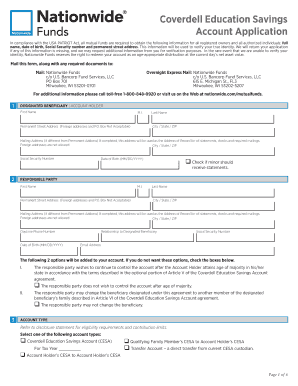

Filling out the Mutual Fund Application for New Accounts at Nationwide Financial online is a straightforward process that facilitates the establishment of your investment account. This guide offers detailed, step-by-step instructions to assist you in accurately completing each section of the application.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the designated beneficiary's information in Section 1. This includes their full name, permanent street address (ensure it is not a P.O. Box), date of birth, and Social Security number. Also indicate if the beneficiary is a minor who should receive statements.

- In Section 2, provide the responsible party's details. Include their name, permanent address, relationship to the designated beneficiary, Social Security number, date of birth, daytime phone number, and email address.

- Choose the account type in Section 3. Options include Coverdell Education Savings Account, Qualifying Family Member’s CESA, or Transfer Account from another custodian.

- In Section 4, select your e-delivery preferences. Indicate whether you wish to receive account statements, reports, and tax forms electronically, keeping in mind that an email address is required.

- Section 5 requires you to indicate your investment choices. List the fund names, investment amounts, and share classes you wish to invest in.

- Specify your distribution options for dividends and capital gains in Section 6, selecting either 'Reinvest' or 'Pay in cash'.

- In Section 7, decide if you accept telephone and internet transaction capabilities. If you wish to decline these options, check the appropriate box.

- Complete Section 8 if you wish to set up an Automatic Investment Plan (AIP), including the frequency of transfers and amounts.

- If applicable, include your bank information in Section 9 for transactions related to AIP or electronic fund transfers.

- Review all sections to ensure accuracy and completeness, then proceed to sign and date the application in Section 12.

- Finally, save your changes, and choose to download, print, or share the form as needed.

Start your application process online today and set your financial future in motion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.