Get 1997 Form 940ez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

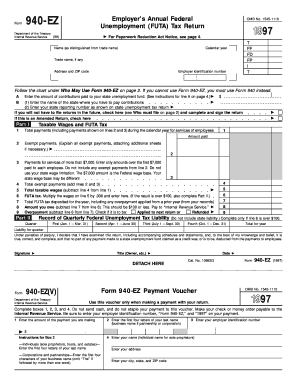

How to fill out the 1997 Form 940EZ online

Filling out the 1997 Form 940EZ is an essential task for employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This guide provides clear steps to assist you in completing the form online, ensuring you accurately report your tax liabilities and responsibilities.

Follow the steps to successfully complete the 1997 Form 940EZ.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and trade name, if applicable, at the top of the form. Next, provide your address and ZIP code, as well as your Employer Identification Number (EIN).

- Indicate the calendar year for which you are filing the form.

- In section A, input the amount of contributions paid to your state unemployment fund. Follow the provided instructions to ensure this amount is accurate.

- For line B, if this is an amended return, check the appropriate box. If you will not have to file returns in the future, check the corresponding box.

- Part I requires entry of your total payments during the calendar year for services of employees on line 1. Include all relevant payments such as salaries and bonuses.

- Enter exempt payments on line 2, and payments over $7,000 for each employee on line 3. Ensure you do not mix exempt payments with taxable amounts.

- Calculate total taxable wages by subtracting the total exempt payments from the total payments and enter the amount on line 5.

- To find your FUTA tax, multiply the amount on line 5 by .008 and enter the result on line 6. If this amount exceeds $100, prepare to complete Part II.

- If applicable, complete Part II by entering your quarterly FUTA tax liabilities. Each quarter's liability should reflect only the amounts taxable during that quarter.

- After you have completed all necessary sections and verified your entries, proceed to save your changes, download, print, or share the completed form as needed.

Start filling out your 1997 Form 940EZ online today to ensure timely and accurate reporting.

You only owe FUTA tax on the first $7,000 you pay to each employee per year (aka the FUTA wage base), excluding any exempt payments. Payments exempt from FUTA include things such as health insurance and life insurance costs and workers' compensation. What's Form 940? Am I Required to File It? - Gusto gusto.com https://gusto.com › resources › articles › taxes › form-940 gusto.com https://gusto.com › resources › articles › taxes › form-940

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.