Loading

Get Nm Rpd-41202 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM RPD-41202 online

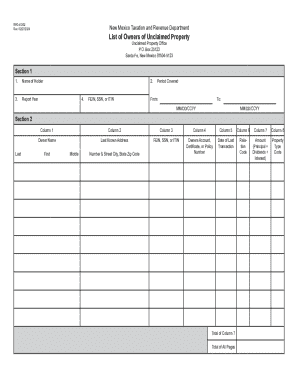

The NM RPD-41202 form is essential for reporting unclaimed property in New Mexico. This guide provides clear, step-by-step instructions to assist users in accurately completing the form online, ensuring compliance with the state's regulations.

Follow the steps to fill out the NM RPD-41202 accurately online.

- Click ‘Get Form’ button to access the NM RPD-41202 and open it for completion.

- In Section 1, enter the name of the holder in the designated field.

- Next, specify the period covered by the report by filling in the 'From' and 'To' date fields using the format MM/DD/CCYY.

- Enter the report year applicable to this form.

- Input the FEIN, SSN, or ITIN of the holder in the corresponding field.

- In Section 2, begin listing owners of unclaimed property. First, in Column 1, enter the owner's last name followed by the first and middle names or initials as applicable.

- Fill in Column 2 with the last known address of each owner as recorded, including the street number and name, city, state, and zip code.

- In Column 3, include the FEIN, SSN, or ITIN for each owner.

- For Column 4, detail any identifying account numbers, certificate numbers, or policy numbers related to the unclaimed property.

- Enter the date of the last transaction pertaining to the property in Column 5, using the appropriate date format.

- Specify the relation code for each owner in Column 6, indicating whether they are a sole owner, beneficiary, or joint owner.

- In Column 7, calculate and input the total amount owed to the owner, including principal, dividends, and interest.

- Complete Column 8 by entering the property type code that matches the funds being reported.

- Ensure each page is numbered consecutively and totals for Column 7 are entered on the last page.

- Once all fields are completed accurately, save changes, and decide whether to download, print, or share the form as necessary.

Start filling out the NM RPD-41202 online today!

The tax is imposed on the gross receipts of persons who: sell property in New Mexico; property includes real property, tangible personal property, including electricity and manufactured homes, licenses (other than the licenses of copyrights, trademarks or patents) and franchises.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.