Loading

Get Authorization For Moving And Relocation Expenses A ... - Uhd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AUTHORIZATION FOR MOVING AND RELOCATION EXPENSES A ... - Uhd online

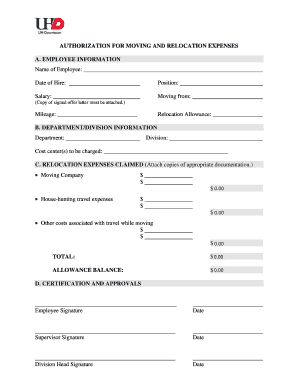

Filling out the authorization for moving and relocation expenses form is an essential step for employees preparing for a move related to their employment. This guide provides clear instructions to help users complete the form accurately and effectively, ensuring all necessary information is included.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to access the authorization for moving and relocation expenses form, which will open the document for you to edit.

- In section A, provide employee information. Fill in your name, date of hire, position, salary, and the location you are moving from. Remember to attach a copy of your signed offer letter.

- Input your mileage and any relocation allowance you are entitled to in the respective fields.

- Navigate to section B and include department and division information. Enter the department, division, and relevant cost centers to be charged for the expenses.

- Move to section C and detail the relocation expenses being claimed. Attach all required documentation. Specify amounts for moving company costs, house-hunting travel expenses, and any other travel costs.

- Calculate the total relocation expenses claimed and enter this amount in the designated area. Also, indicate the allowance balance if applicable.

- Proceed to section D. Sign and date the certification area alongside your supervisor and the division head to complete the approval process.

- After completing all sections, ensure all changes are saved. You may then proceed to download, print, or share the form as needed.

Complete your authorization for moving and relocation expenses form online to ensure a smooth relocation process.

For one thing, you can make moving cost payments to employees using a nonaccountable plan. These payments will be subject to income and payroll taxes and the taxable amounts must be reported to the IRS. If you make payments under an accountable plan, they're also taxable to employees in 2024 and 2025.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.