Get Irs 20 Factor Test

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 20 Factor Test online

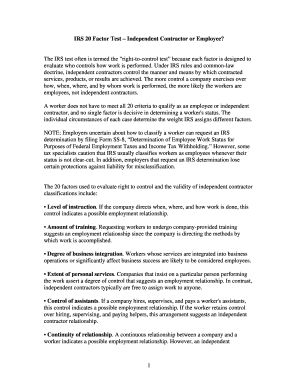

The IRS 20 Factor Test is a crucial tool for determining whether a worker should be classified as an independent contractor or an employee. Understanding how to complete this form online can help ensure proper classification and compliance with tax obligations.

Follow the steps to complete the IRS 20 Factor Test online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editing tool.

- Begin with the introductory section of the form, which may ask for the names and contact information of both the worker and the employer. Make sure to fill in accurate information.

- Proceed to the 20 factors section. Here, you will evaluate each factor in relation to the working relationship. Carefully read each question and provide honest, thorough responses.

- For each factor, consider how much control is exercised over the worker, including elements like instructions, training, and methods of payment. Document instances that support your classification.

- Complete any additional sections that pertain to specific details or agreements regarding the worker's status. This may include contracts or previous communications.

- After filling out the entire form, review all entries to ensure accuracy. Make any necessary corrections prior to finalizing the document.

- Once satisfied with the completed form, you can save changes, download a copy for your records, print it for physical submission, or share it as needed.

Start filling out your IRS 20 Factor Test online today to clarify worker classifications and ensure compliance.

The IRS primarily considers three factors to determine worker status: behavioral control, financial control, and the relationship nature. Behavioral control assesses how much direction an employer has over the work performed; financial control looks at the business aspects of the worker's job; the relationship factor focuses on how both parties perceive their interaction. Applying these factors accurately can help you classify workers correctly using the IRS 20 Factor Test.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.