Loading

Get The University Of Georgia Petition To Be Declared An ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the THE UNIVERSITY OF GEORGIA Petition To Be Declared An Independent Student for Federal Aid online

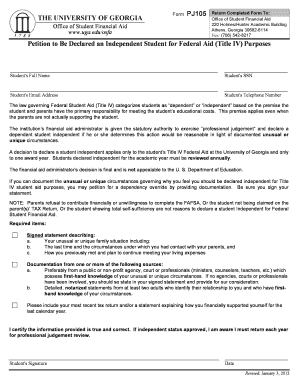

Filling out the Petition to Be Declared an Independent Student for Federal Aid at the University of Georgia is a crucial step for students seeking independence regarding their financial aid status. This guide will provide you with a clear, step-by-step approach to ensure you complete the form accurately and effectively.

Follow the steps to successfully complete your petition.

- Click the ‘Get Form’ button to access the petition form and open it in the editor.

- Provide your full name in the designated field to identify yourself as the petitioner.

- Enter your Social Security Number in the appropriate section to help verify your identity.

- Fill in your email address, ensuring it is a valid email so the university can contact you if needed.

- Input your telephone number for communication purposes regarding your petition.

- Write a signed statement describing your unusual or unique family situation, detailing your last contact with your parents and how you support yourself financially.

- Attach relevant documentation from a public agency, court, or professionals who have knowledge of your circumstances. If unavailable, provide notarized statements from at least two adults who can vouch for your situation.

- Include your most recent tax return or a statement explaining how you supported yourself financially in the previous calendar year.

- Review all your entries for accuracy and completeness.

- Sign and date the document to certify that the provided information is true and correct.

- Once completed, save your changes, download a copy of the form, print it if necessary, or share it as required.

Complete your petition online and take a significant step toward securing your financial independence.

Georgia Residency Requirements for Tax Purposes If a person resided in Georgia for 183 days or longer over any consecutive 12-month period concluding in the current tax year, they are recognized as Georgia tax residents. For each tax period, the resident or non-resident status is determined.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.