Loading

Get Us Bank Closing E14 2002-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the US Bank Closing E14 online

Filling out the US Bank Closing E14 form online is a straightforward process that ensures all necessary details regarding your mortgage agreement are accurately captured. This guide provides you with clear, step-by-step instructions to help you through the form-filling process with confidence.

Follow the steps to complete the US Bank Closing E14 form effectively.

- Press the ‘Get Form’ button to access the US Bank Closing E14 form and open it in your digital format for editing.

- Enter your name or the names of all borrowers in the section labeled 'BORROWER(S)'. Ensure that the spelling is accurate.

- Fill in the 'PROPERTY ADDRESS' section with the complete address of the property connected to the mortgage agreement.

- Indicate the 'MORTGAGE TYPE' by selecting the relevant type of mortgage from the options provided.

- Input the 'NOTE RATE', which is the interest rate agreed upon for the mortgage loan.

- Specify the 'LOAN AMOUNT', the total amount of the mortgage loan you are requesting.

- Detail the 'TERM (MO's)' by entering the duration of the loan in months.

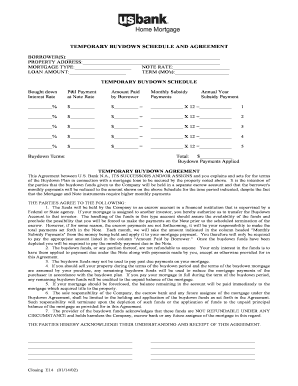

- Complete the 'TEMPORARY BUYDOWN SCHEDULE' table by entering the bought down interest rates, P&I payments at the note rate, amount paid by borrower, and monthly subsidy payments for each year as applicable.

- Review the 'Buydown Terms' section to ensure that the annual subsidy payment total is clearly documented.

- Read through the 'TEMPORARY BUYDOWN AGREEMENT' and ensure that you understand the terms and your responsibilities regarding the buydown funds.

- Once all sections are filled out accurately, you can save changes, download a copy of the form, print it if necessary, or share it as needed.

Complete your documents online to ensure a smooth mortgage process.

The collapses of Silicon Valley Bank and Signature Bank in March 2023—then the second- and third-largest bank failures in U.S. history—took consumers by surprise. Subsequently, three more banks failed in 2023: First Republic Bank in May, Heartland Tri-State Bank in July and Citizens Bank of Sac City in November.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.